This software is compatible on both Windows or Mac systems.

You will receive your download and product code instantly via email.

Simply pay once for a lifetime license which never expires.

Download direct from Intuit website with step-by-step installation guide.

You will receive your download and product code instantly via email.

This software is compatible on both Windows or Mac systems.

Simply pay once for a lifetime license which never expires.

Download direct from Intuit website with step-by-step installation guide.

$699.99 Original price was: $699.99.$199.99Current price is: $199.99.

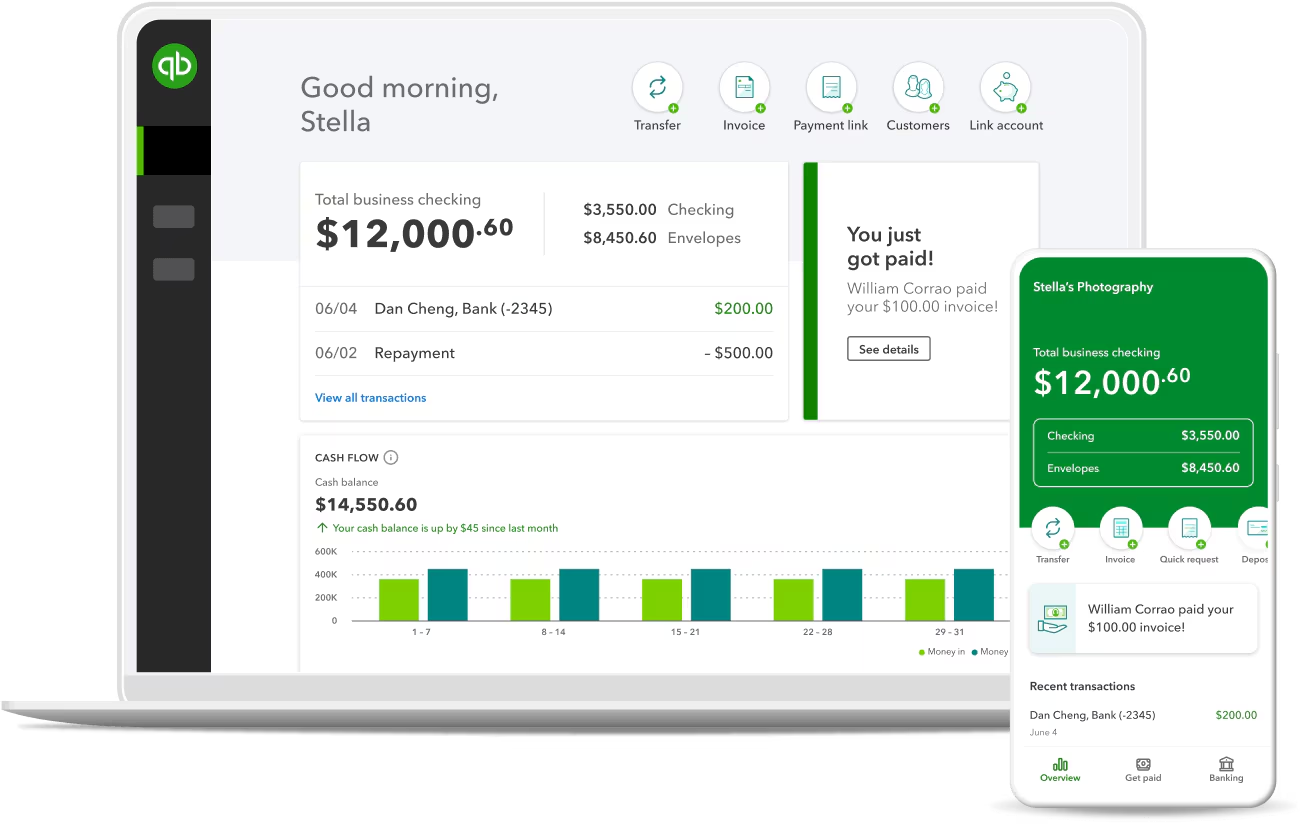

Take full control of your business finances with Intuit® QuickBooks® Desktop Pro Plus 2024 – Lifetime Activation for Windows. This robust accounting solution brings together all the essential tools you need for bookkeeping, expense tracking, invoicing, and financial reporting—within a single, user-friendly platform.

Perfect for small business owners, freelancers, and accountants, QuickBooks® Desktop Pro Plus 2024 delivers precision, efficiency, and hassle-free financial management. Stay organized, save time, and make smarter decisions—no subscriptions, just lifetime access.

Yes, QuickBooks supports importing data via Excel or CSV files. For certain software like Quicken or older QuickBooks versions, there are specific import tools. You may need to map fields correctly to ensure data accuracy.

Yes, QuickBooks offers integrated payroll options, including automatic tax calculations, direct deposit, and employee self-service portals.

NOTE: Payroll has to be manually added. We can guide you through this once you purchase.

Take full control of your business finances with Intuit® QuickBooks® Desktop Pro Plus 2024 – Lifetime Activation for Windows. This robust accounting solution brings together all the essential tools you need for bookkeeping, expense tracking, invoicing, and financial reporting—within a single, user-friendly platform.

Perfect for small business owners, freelancers, and accountants, QuickBooks® Desktop Pro Plus 2024 delivers precision, efficiency, and hassle-free financial management. Stay organized, save time, and make smarter decisions—no subscriptions, just lifetime access.

Take full control of your business finances with Intuit® QuickBooks® Desktop Pro Plus 2024 – Lifetime Activation for Windows. This robust accounting solution brings together all the essential tools you need for bookkeeping, expense tracking, invoicing, and financial reporting—within a single, user-friendly platform.

Perfect for small business owners, freelancers, and accountants, QuickBooks® Desktop Pro Plus 2024 delivers precision, efficiency, and hassle-free financial management. Stay organized, save time, and make smarter decisions—no subscriptions, just lifetime access.

Yes, QuickBooks supports importing data via Excel or CSV files. For certain software like Quicken or older QuickBooks versions, there are specific import tools. You may need to map fields correctly to ensure data accuracy.

Yes, QuickBooks offers integrated payroll options, including automatic tax calculations, direct deposit, and employee self-service portals.

NOTE: Payroll has to be manually added. We can guide you through this once you purchase.

Partnering with us means you gain access to trusted QuickBooks solutions, tailored support, and unmatched value. We pride ourselves on delivering:

Address:

783 Pinewood Rd, Union, NJ 07083, USA

Email:

support@quickbookcode.com

Phone:

+1 (917) 764-9716

Office Hours:

Mon-Friday between 09:00 am to 07:00 pm.

(GMT-08:00) PST Pacific Standard Time

Copyright ©2025 QuickBook Code. All rights reserved.